Although the Inflation Reduction Act of 2022 (IRA) aimed to increase patient access to prescription drugs and decrease spending, researchers warn that it may have unintended negative impacts on patients in the long run.

A new USC Schaeffer Center white paper recommends three strategies to mitigate adverse impacts of the IRA.

“The IRA lowers drug prices, but at the expense of innovation,” says Dana Goldman, co-director of the USC Schaeffer Center for Health Policy & Economics and dean of the USC Price School of Public Policy. “The question is by how much? More transparency around value assessment will improve HHS’ price negotiation process.”

Adverse effects of the IRA

The IRA made sweeping changes to Medicare’s prescription drug benefit, including requiring the Department of Health & Human Services (HHS) to negotiate “maximum fair prices” with drug manufacturers for brand name drugs with the highest spending that do not have generic or biosimilar competitors. The IRA also penalizes manufacturers who increase list prices faster than inflation and reforms key aspects of the Medicare prescription drug benefit (Part D).

Goldman and colleagues discuss four ways the IRA could negatively impact biomedical innovation and health plan coverage decisions, including a reduction in the discovery of new treatments and new applications for existing treatments, reduced generic competition, and compromises to health plans’ ability to negotiate prices based on value.

“There is an inherent tradeoff here between the patients of today and the patients of tomorrow,” says Erin Trish, co-director of the USC Schaeffer Center. “It is important to recognize and mitigate the potential negative consequences on the latter.”

Regulators should focus on transparency and value to mitigate negative effects

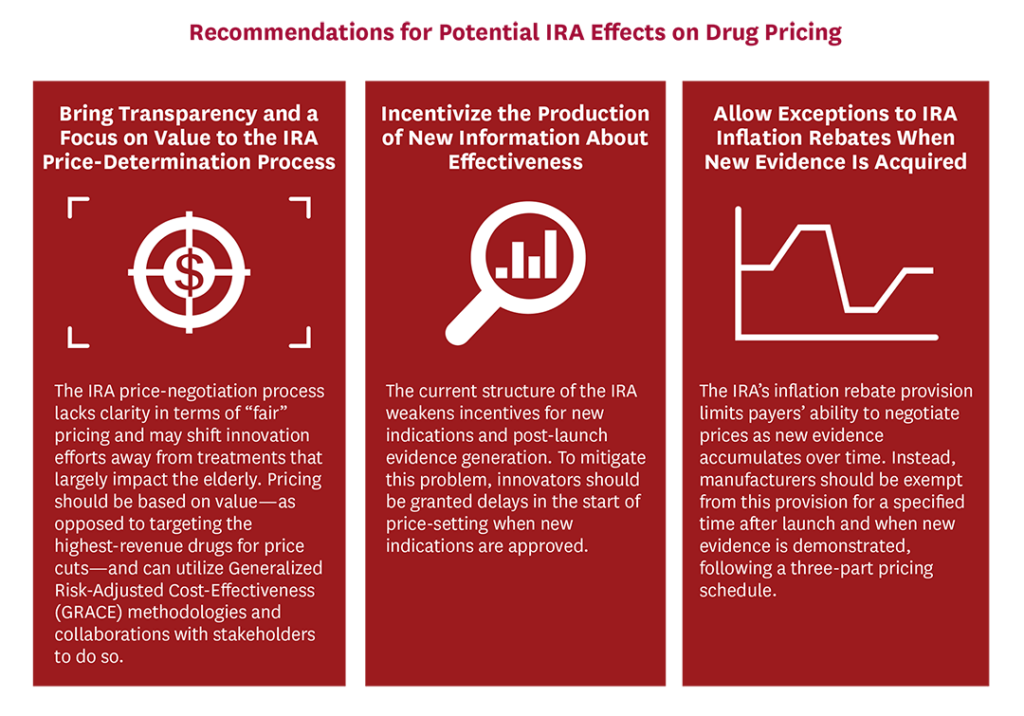

To mitigate these effects, the white paper offers three recommendations that, when taken together, could help regulators ensure increased innovation, greater patient access and lower costs:

1. Bring transparency and a focus on value to the IRA price-determination process.

To assess value, economists commonly use cost-effectiveness analysis (CEA), but traditional, quality-adjusted life-year-based CEA can discriminate against patients who are disabled, elderly or have complex conditions. Generalized risk-adjusted cost-effectiveness (GRACE) is a new method that takes into account these concerns by aligning estimates with patient preferences. Specifically, GRACE accounts for the fact that people value health gains most when facing very poor quality of life.

“At risk is the ability to put in place a transparent framework that reflects patients’ interests,” says Darius Lakdawalla, director of research at the USC Schaeffer Center. “By using a framework like GRACE, regulators could in a transparent, clear way evaluate the value of new technologies and the benefit they offer to patients.” Without such a framework, it is unclear how patient preferences will be systematically considered, argue the researchers.

2. Incentivize the production of new information about effectiveness.

Many drugs acquire new indications over several years after the drug is launched and real-world data of alternative beneficial uses is gathered, which can help many more patients than originally intended when the drug was discovered. Delaying price negotiation when new, valuable evidence is created would incentivize manufacturers to invest in the clinical trials necessary to gather that evidence.

3. Allow exceptions to the IRA inflation rebates when new evidence is acquired.

Finally, the researchers recommend that HHS implement a more flexible, three-part pricing framework that is tied to real-world data about the value of these drugs, allowing for increased pricing for drugs that work better, and lower prices for those that don’t.

“The U.S. develops more biomedical breakthroughs than any other country,” says Joe Grogan, a nonresident senior fellow at the USC Schaeffer Center. “Regulators need to ensure that the implementation of the IRA does not jeopardize this innovation and the health of future generations.”

The three recommendations aim to balance the IRA’s goals of incentivizing innovation, increasing access and reducing cost.

Funding for this paper was provided by the USC Schaeffer Center. Barry Liden, director of public policy at the Schaeffer Center, Jason Shafrin, senior managing director at the Center for Healthcare Economics and Policy at FTI Consulting and Kyi-Sin Than, director at the Center for Healthcare Economics and Policy at FTI Consulting contributed to the paper.

You must be logged in to post a comment.